Table of Contents

TogglePayroll Management

Accurate, Automated, Transparent

Workway’s Payroll Management module streamlines your salary process, making it accurate, timely, and fully integrated with attendance, time logs, expenses, and compliance.

* No credit/debit card required

Admin & HR Panel: Total Salary Management Control

Manage payroll operations confidently for your entire organization:

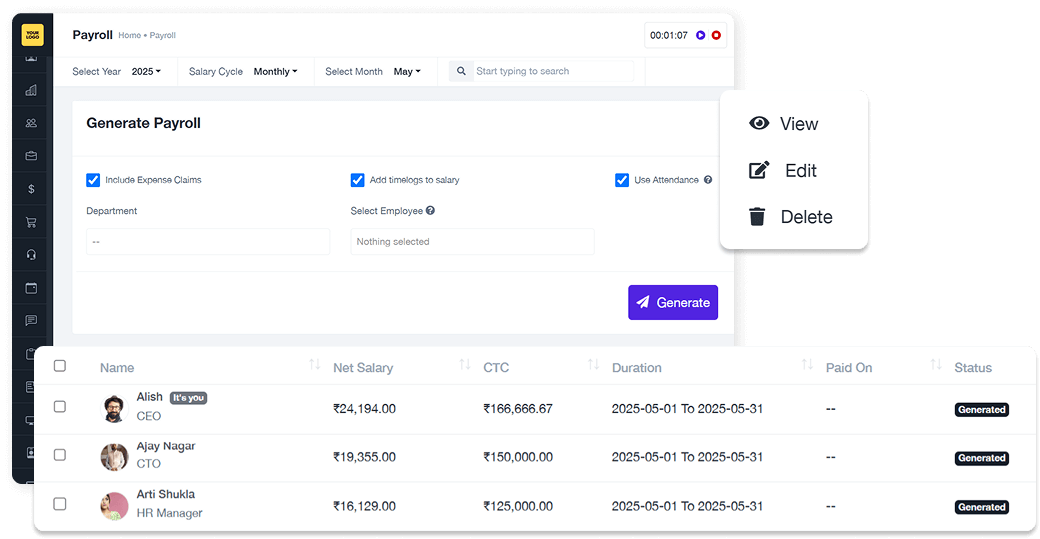

Payroll Generation

Generate Monthly Payroll by selecting:

- Department

- Specific Employees

- Payroll Month/Period

Link employee Timelogs (hours worked) and Attendance records automatically into salary

calculations.

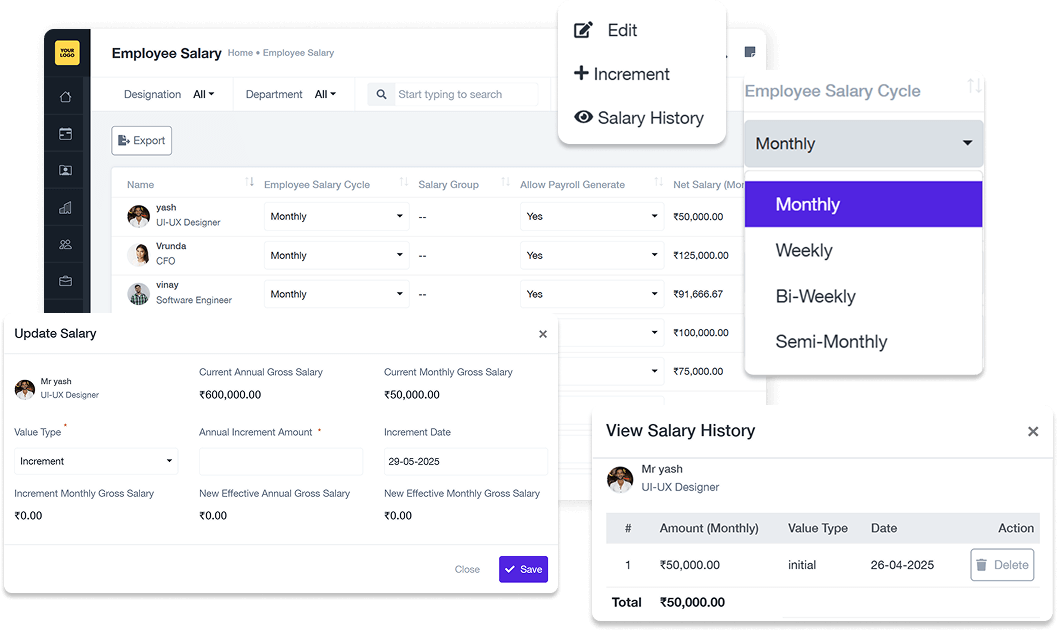

Salary Management

- Set up Employee Salary Structures

- Basic

- Allowances

- Deductions

- Bonuses

- Customize per employee or per role.

- Manage bonuses, arrears and deductions separately.

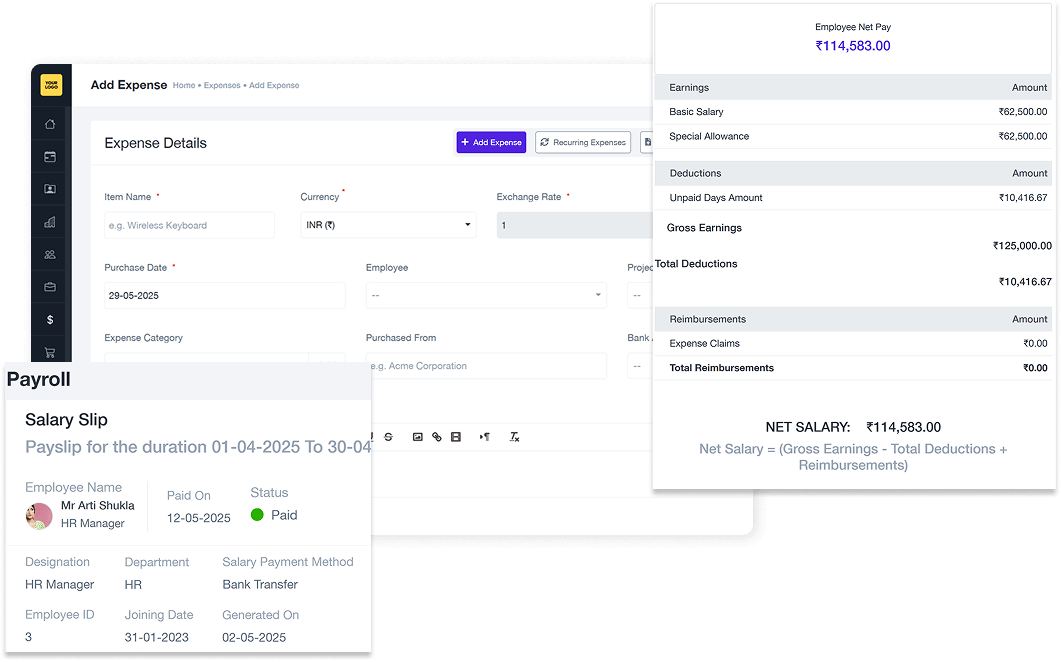

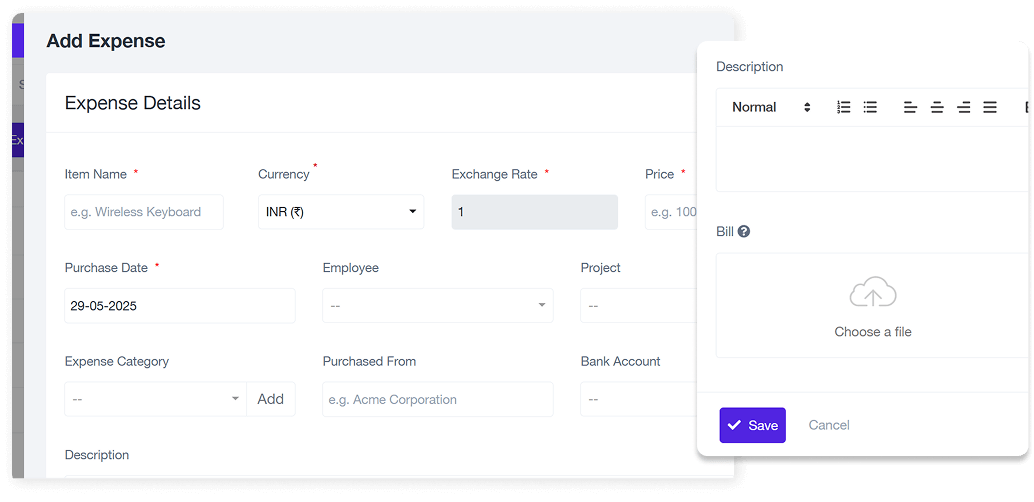

Expenses Management

-

Record and track Company Expenses related to payroll

e.g., reimbursements, benefits - Approve or reject Employee Expenses linked to salary payout.

- Manage Recurring Expenses easily.

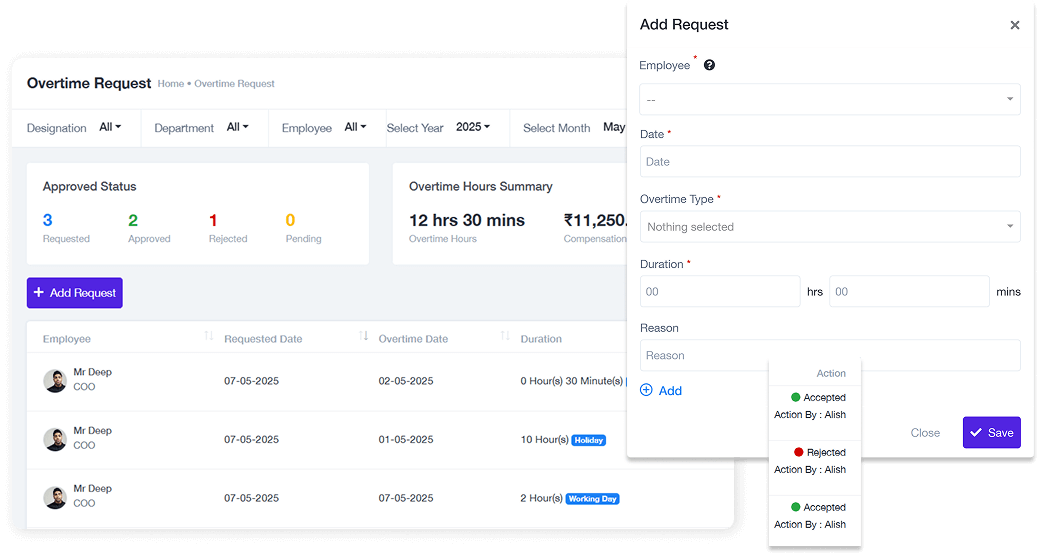

Overtime Management

- Employees can request Overtime directly from their portal.

- HR/Admin can:

- Approve or Reject requests

- Track Overtime Hours Summary

- Auto-add approved overtime to salary calculation

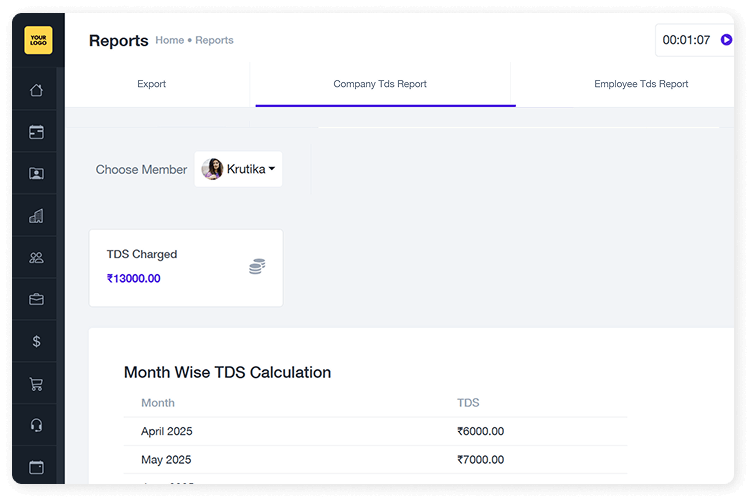

TDS (Tax Deducted at Source) Management

- Review and download:

- Company TDS Reports

- Individual Employee TDS Reports

- Export TDS reports in Excel or PDF formats easily.

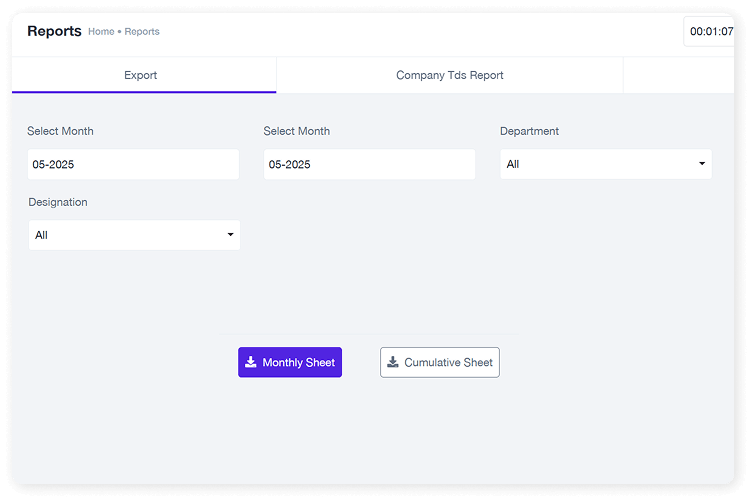

Export Payroll Reports

- Salary reports,

- TDS reports,

- Expense reports

- all exportable with one click.

Employee Panel: Transparent Self-Service

Give employees complete visibility over their payroll without HR intervention.

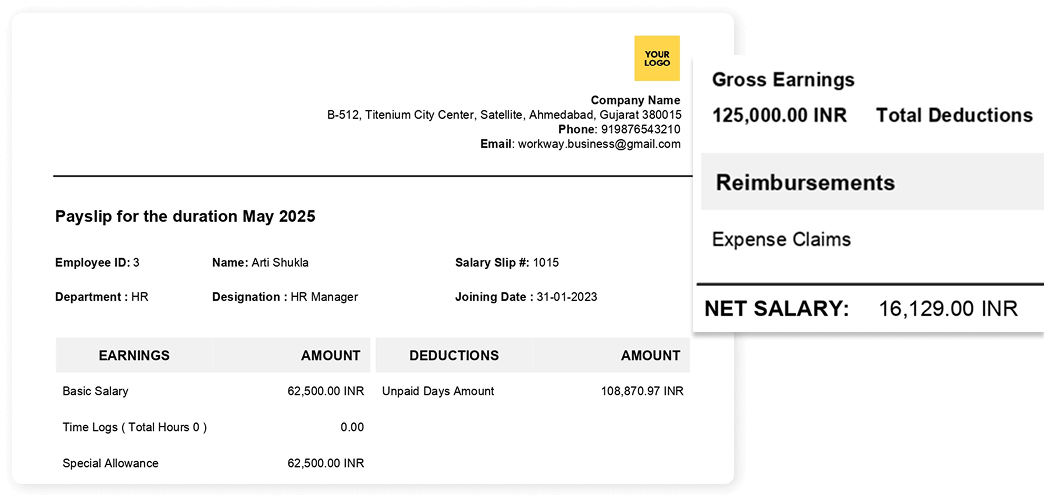

Salary Slip Download

Employees can securely view and download monthly Salary Slips.

See breakup of:

- Basic Pay

- Allowances

- Overtime

- Deductions (PF, TDS, Advances)

Expense Management

- Submit Expense Claims with Receipts

- Track Approval Status and Payment Updates

Advanced Payroll Capabilities

Everything you need to manage salaries, taxes, expenses, and compliance—accurately, securely, and efficiently.

- Seamless IntegrationAttendance, Timesheets, HRM, and Auto-Calculation for Payroll, Overtime, TDS, and Expenses.

- Smart, Secure & ScalableRole-Based Access, Data Encryption, Bulk Payroll Generation.

- Global ReadyFull Multi-Currency Support for international teams.

Trusted by Businesses Like Yours

Shradha Kumari, CEO

YOURDORLD PVT. LTD.

Shradha Kumari, CEO

YOURDORLD PVT. LTD.

Shradha Kumari, CEO

YOURDORLD PVT. LTD.

Workway Tips, Trends & Tactics

Frequently asked questions

What does the Payroll Management module offer?

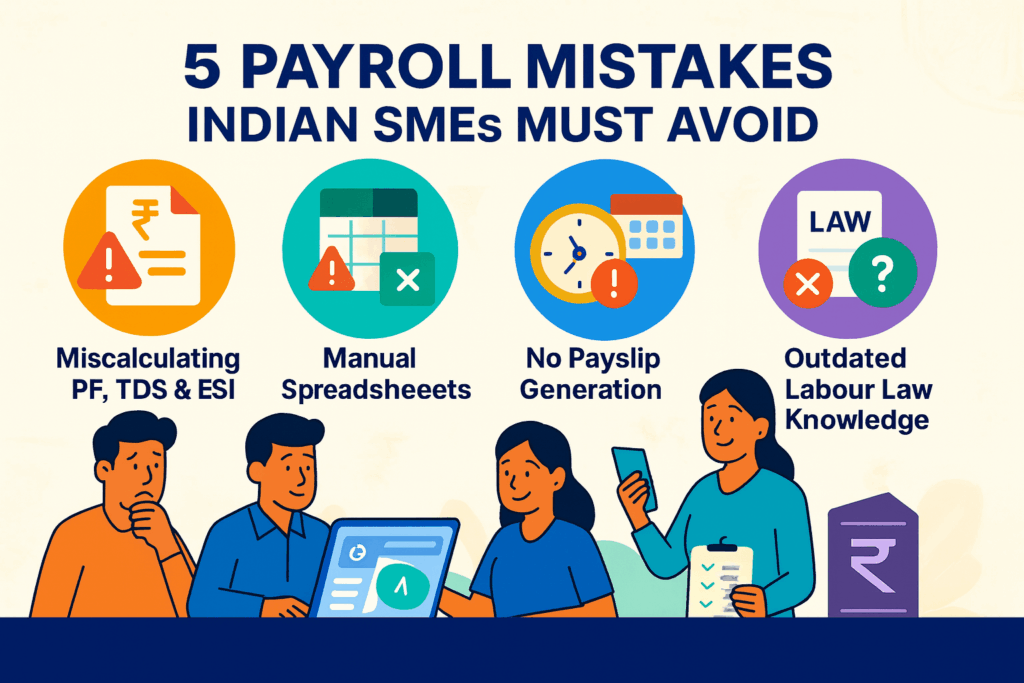

The module provides automated salary calculations, integrates attendance, leave, TDS, bonuses/deductions, and generates salary slips automatically. It also tracks Paid and Unpaid statuses with record logs for each pay cycle.

How does payroll integrate with attendance and leave?

Workway automatically pulls data from the Attendance & Leave modules. Salaries are adjusted based on working days, leave taken, and absences, ensuring accuracy without manual errors.

Can I apply bonuses, deductions, or TDS manually?

Yes. Payroll supports custom bonuses, deductions, and TDS percentages per employee. These can be configured and logged individually for each pay cycle.

How are salary slips generated and shared?

After calculation, you can generate PDF salary slips for all employees, which are downloadable or shareable with the team. Each slip includes components, deductions, and net salary clearly.

Does the module show who has been paid?

Yes, there’s a Payment Status tracker that shows Paid vs Unpaid for each employee. You can filter by shift, department, or pay date.

Can payroll be processed for teams of different sizes?

Absolutely. Workway supports payroll for solo users, SMEs, and 5000+ employees – handling any team size with easy configuration and scalability.

Is data secure during payroll processing?

Workway ensures payroll data security with role-based access, end-to-end encryption, access logs, and optional SSO/2FA, keeping sensitive salary information protected.

Do I need an accountant to use this module?

No. Workway’s system is easy to use, with automated calculations and structured outputs — eliminating the need for manual Excel processing or a dedicated accountant for payroll.

Can I run payroll for past months?

Yes, the system allows backdated payroll runs, letting you manage corrections, late approvals, or new joiners. Each month’s payroll can be processed independently.

Digital Workplace

A Secure, Scalable Cloud

End-to-end encrypted. Role-based access. Built-in SSO, access logs, and 2FA.

workway.pro runs on a private, enterprise-grade cloud infrastructure designed for performance, scalability, and control fully hosted and managed in India.

“These logos represent compliance frameworks that inspire Workway’s data and infrastructure practices. Formal certifications may be pursued in future.”