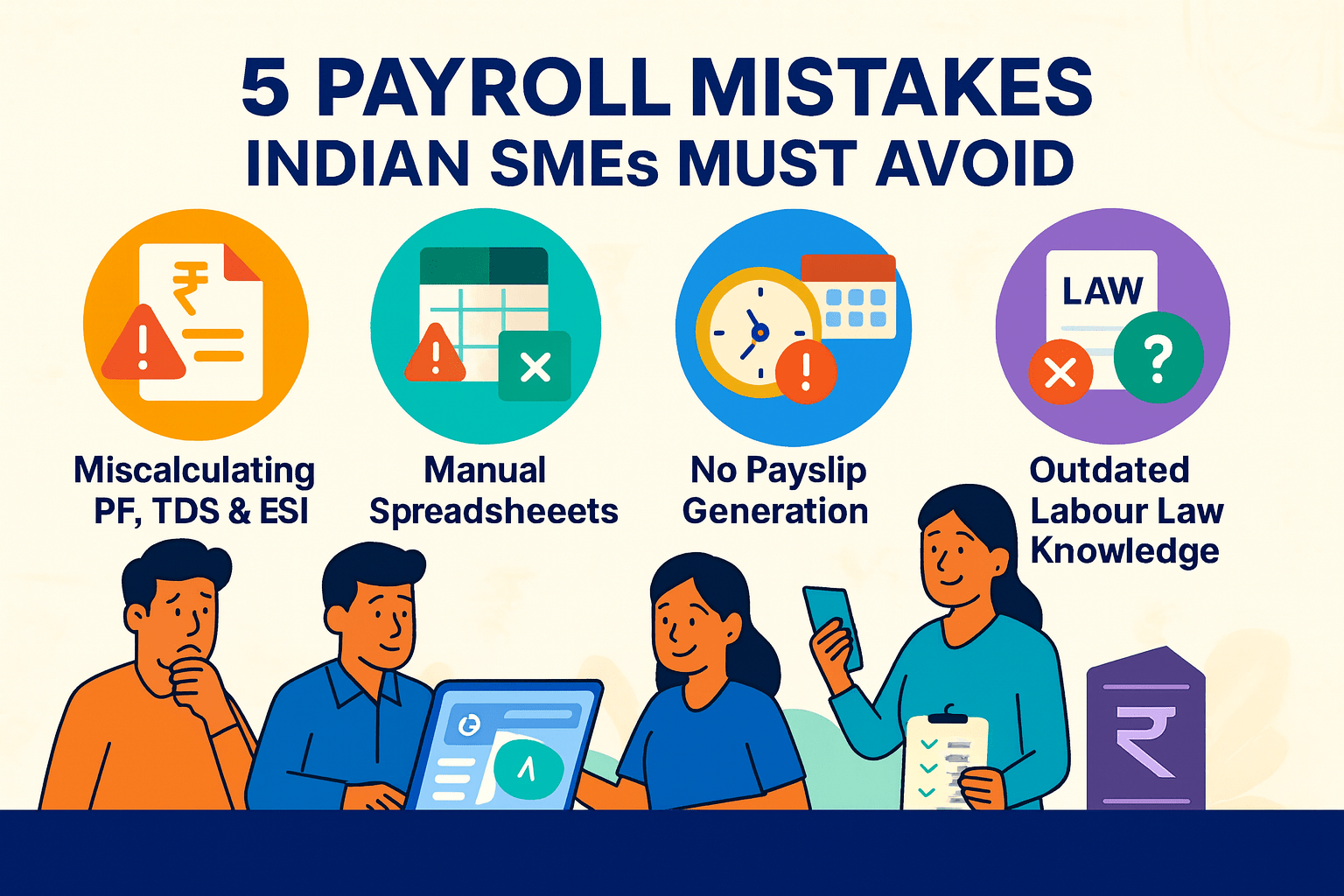

5 Costly Payroll Mistakes Indian SMEs Should Avoid

🚫 Top 5 Payroll Mistakes in Indian SMEs You Should Avoid

Payroll mistakes Indian SMEs commonly make are more dangerous than they seem — they can lead to compliance issues, penalties, and unhappy employees.

Even a minor slip-up can lead to penalties, employee dissatisfaction, or worse, legal trouble.

Most payroll mistakes in Indian SMEs happen because of outdated systems, unclear processes, or a lack of automation.

These are exactly the types of payroll mistakes Indian SMEs can avoid with the right tools and proactive processes in place.

In this blog, we’ll walk you through 5 of the most common payroll mistakes Indian SMEs make, how they impact your business, and what you can do to prevent them.

Common Payroll Mistakes Indian SMEs Must Avoid

1. ❌ Miscalculating or Delaying PF, TDS & ESI Deductions

The Problem:

Many small businesses either miscalculate contributions or delay their statutory filings for Provident Fund (PF), Tax Deducted at Source (TDS), or Employee State Insurance (ESI). These aren’t just clerical errors—they’re legal liabilities.

The Impact:

Heavy fines or interest charges from the government

Compliance audits or legal notices

Loss of employee trust

How to Avoid It:

Use HR software that’s India-compliant and auto-calculates PF, TDS, and ESI based on the latest rules

Set automated reminders for filing deadlines

Work with a trained payroll expert or service if needed

🛠 Workway.pro is fully built to handle India’s statutory deductions automatically—no guesswork needed.

2. ❌ Relying on Manual Spreadsheets for Payroll

The Problem:

Excel might be free, but it’s prone to formula errors, version issues, and data security risks. Many SMEs still manage payroll manually, which leads to duplicated data, missed entries, or even salary miscalculations.

The Impact:

Incorrect payslips or underpaid employees

Wasted hours fixing errors

No audit trail or centralized history

How to Avoid It:

Switch to cloud-based payroll tools that offer automated calculations and reports

Ensure real-time data entry and role-based access for your HR or finance team

Always back up data securely

If not addressed early, these payroll mistakes Indian SMEs make can snowball into legal trouble and employee dissatisfaction.

3. ❌ Inaccurate Attendance and Leave Tracking

The Problem:

Payroll is directly linked to attendance and leave data. But if your attendance records are on paper registers or outdated punch cards, it’s easy to process the wrong salary.

The Impact:

Overpaying or underpaying staff

Disputes and dissatisfaction among employees

Compliance risks if salary slips don’t reflect actual working days

How to Avoid It:

Use GPS-based or biometric attendance tracking integrated with payroll

Automate leave accruals and carry-forwards

Allow employees to view and apply for leaves via self-service portals

📲 Workway.pro connects attendance, leave, and payroll seamlessly—reducing errors and saving hours every month.

4. ❌ Missing Payslip Generation and Salary Proof

The Problem:

Some SMEs forget or delay issuing monthly payslips—especially when payroll is done manually. In many cases, employees don’t even receive official proof of income.

The Impact:

Employees can’t apply for loans, credit, or visas

Lack of transparency can cause employee dissatisfaction

It violates the Shops & Establishments Act in most Indian states

How to Avoid It:

Automate payslip generation on salary processing day

Make payslips accessible through employee self-service portals

Add all required details like deductions, gross, and net pay

5. ❌ Not Staying Updated with Labor Law Changes

The Problem:

Payroll rules in India evolve frequently—new PF caps, bonus amendments, or digital tax rules. If you’re unaware or late to adapt, you risk non-compliance.

The Impact:

Unintentional law violations

Penalties during inspections or audits

Confused HR processes

How to Avoid It:

Subscribe to official updates or follow HR regulatory blogs

Use payroll software that updates compliance rules in real time

Conduct quarterly audits of your payroll process

🎯 Final Thoughts: Payroll Shouldn’t Be Guesswork

For Indian SMEs, payroll is more than just cutting cheques—it’s about building trust, staying compliant, and keeping operations smooth. Avoiding these common mistakes can save your business thousands in penalties and hours of rework.

By avoiding these payroll mistakes in Indian SMEs, you can save time, reduce errors, and create a better experience for both your team and your bottom line.

👉 If you’re tired of juggling spreadsheets, compliance stress, and payroll chaos—Workway.pro was built for you.

Start simplifying your payroll today with an India-first solution.